Buying a house is a big ticket item expenses. Most buyers are likely taking a home loan to finance the purchase. To get an approval for a home loan application, buyers must show they qualify for the home loans through the documentation. If the home loan documents are not well prepared, banks may reject the loan application. The reason is that banks can only make assessment based on the documents they received from the applicants.

Prior to making a loan, a buyer needs to identify what category they are belong to. Broadly speaking, most Malaysian buyers can be categorized as employee, self-employed and working in Singapore (or abroad).

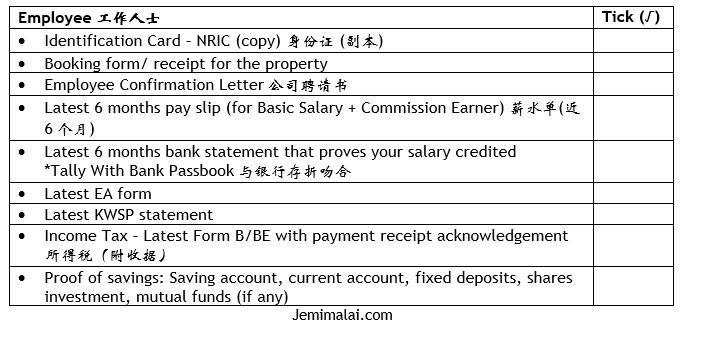

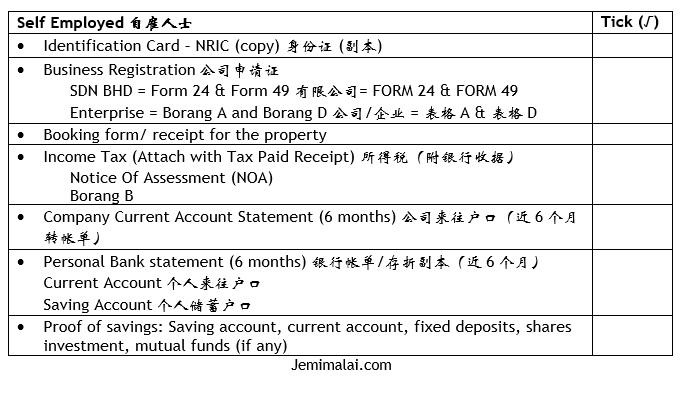

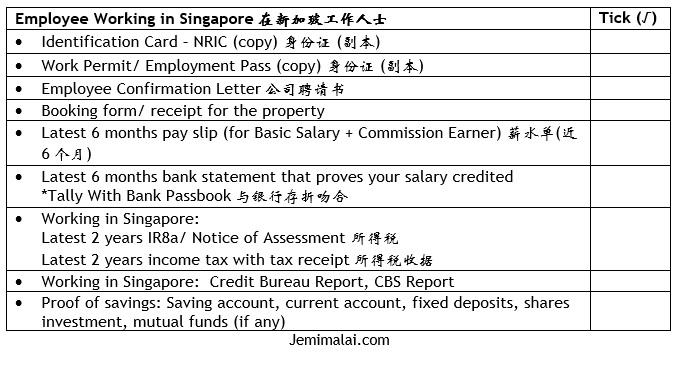

A complete list of documents is shown at below:

Malaysian borrower who works in Malaysia – Employee

Malaysian borrower who running a business – Self Employed

Malaysian borrower who works in Singapore – Employee

After preparing the documents, you may apply a home loan after obtaining a booking from for the property.

Still have questions? You may seek professional bankers, mortgage consultants or estate agents or real estate negotiator for help.

Good luck!

To learn about how to get a best home loan, see our guide: